The Ultimate Guide to Retail Leasing: Finding a Space for Your Retail Business

It can be overwhelming to think about how to grow a business. At what point is your business ready for a dedicated retail space? And how do you decide where to lease?

In the time of COVID-19, it may not seem like an ideal time to set up a physical shop. While many businesses are in various stages of closure, the pandemic has caused widespread commercial rent decreases.

Last year, the average retail rent in the US dropped 0.7%. This was the first decline in nine years.

If you’re even somewhat considering it, now is the time to check out a lease. So let’s get started. We’ve tackled some of the most common questions around leasing retail space.

Table of Contents

How does leasing retail space work?

Let’s start with the most basic question and break down the answer into a series of steps.

Step one is finding your potential retail space.

Do you know where you want to be located?

If not, then take some time to think about your clients. Being located near where your clients live and work is key. A retail space that is accessible to street traffic and has ample parking are also considerations. Could your store sales increase from walk-ins? Or does a more private or discrete location work fine?

These questions are key to determining where you start your search for a retail space.

Step two is making calls.

Once you’ve narrowed your search, you can begin calling property managers and leasing brokers. You may find a phone number on a For Lease sign. Or you may have to track down the right people.

Consider going into a store next door to the space you’re interested in. Ask them who their landlord is and go from there.

Step three is negotiating.

There are several different types of leases. The way a lease is structured can determine what you are on the hook for and what extra expenses you’ll owe monthly. We’ll break down the lease types later on.

During the negotiation, come prepared with your budget. Don’t walk into a lease negotiation meeting without having done the math on what you can afford. Calculate how much more you’ll need to charge for your products and services to cover monthly rent.

You may be asked to sign a letter of intent before signing the lease. This is a non-binding agreement stating the lease’s terms and conditions. Letters of intent are not mandatory, but landlords and brokers often request them to move forward with negotiations.

Step four is signing a lease.

Don’t be afraid to walk away from a negotiation meeting without a signed agreement. Ask for time to review the contract.

If you have a business mentor, wealth adviser, or fellow retail store-owner friend, get their two cents. They may know what questions you haven’t asked that you need to. And you’ll be able to make a more informed decision.

Before you commit to a year or more of monthly payments on a retail space, make sure you’ve read and understand the lease agreement.

EXPERT TIP: Leases are binding. And terminating a lease early can be costly. Consider hiring a tenant broker to help you navigate the lease evaluation and signing process.

What should I look for when leasing a retail space?

There are lots of different things to look for when evaluating a retail space. In fact, there are so many different considerations to take into account that it can become overwhelming.

Use these two checklists when looking for a retail space.

Physical space checklist:

- Co-tenants: Are co-tenants competitive or complementary to your business?

- Parking: Does the lease include parking? If not, is there street parking or a deck/lot nearby?

- Frontage: Is there a storefront with a sidewalk for walk-ins and foot traffic? Could you easily manage curbside pickup?

- Signage: Is there a sign on the building or pylon? Is it shared with other businesses?

- Condition: What is the age of the space? Does it need updating?

- Bathroom: Are there bathrooms in the building? Are they shared with other businesses?

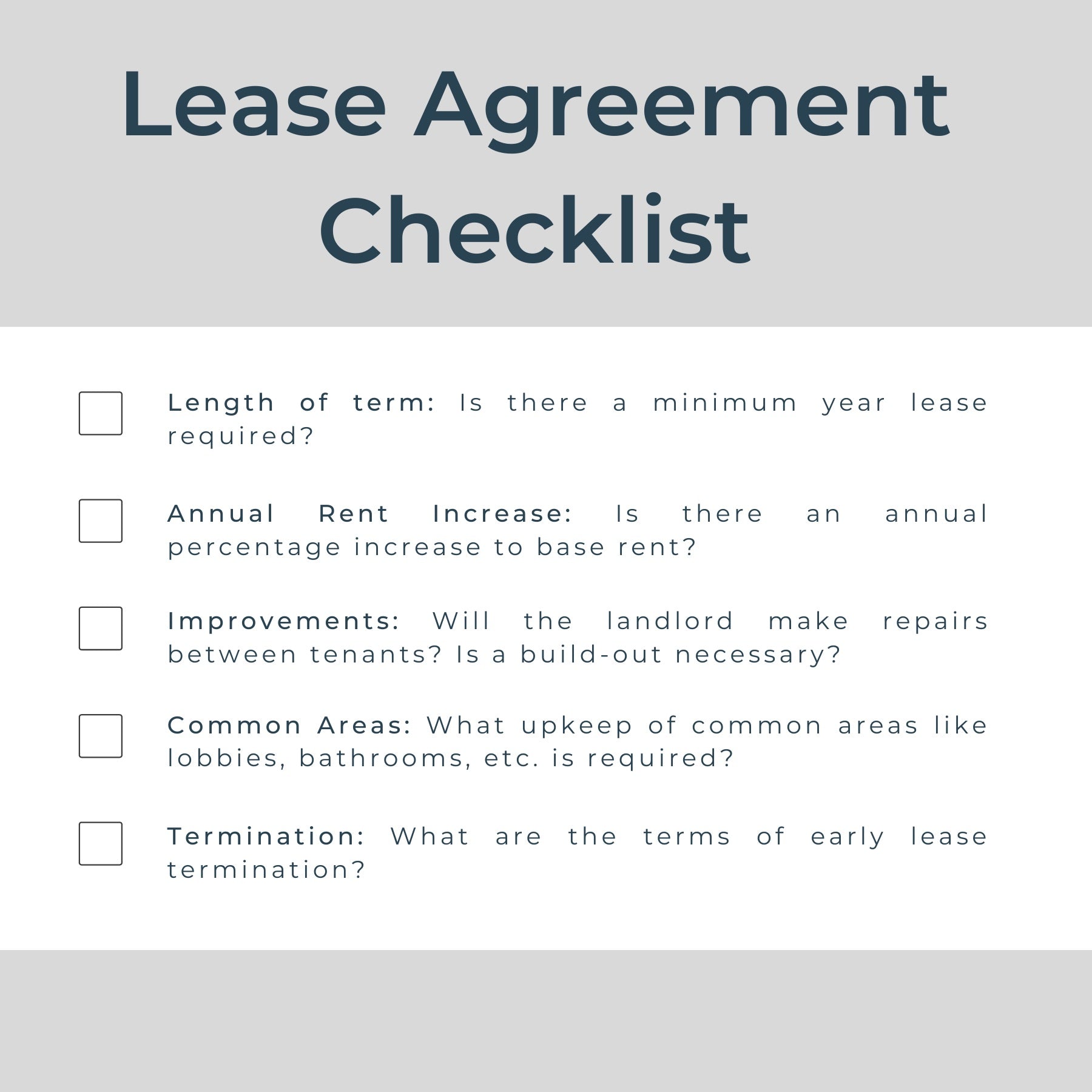

Lease agreement checklist:

- Length of term: Is there a minimum-year lease required?

- Annual rent increase: Is there an annual percentage increase to base rent?

- Improvements: Will the landlord make repairs between tenants? Is a build-out necessary?

- Common areas: What upkeep of common areas like lobbies, bathrooms, etc., is required?

- Termination: What are the terms of early lease termination?

These checklists will get you started asking the right questions. For small business owners, leasing a retail space can feel like a big risk. There’s both a financial and a resource investment to renting a space.

Knowing as many of the unforeseen challenges as possible is important.

EXPERT TIP: Reach out to an existing tenant in the space that you’re considering. Ask about the pros and cons of renting the space and run through your checklists with them. Get an insider’s perspective before you sign the lease.

What type of lease is common for retail spaces?

The most common type of retail or commercial space lease is a triple-net lease (NNN). In a NNN lease structure, tenants are responsible for a base rent and additional expenses. This formula looks like this:

- Triple-Net Lease (NNN) = Base Rent + Additional Expenses

The additional expenses include property taxes, insurance, and common area maintenance expenses.

The base rent in a NNN agreement is typically lower because tenants help pay the ongoing operational costs of the building. It’s low risk for the landlord and requires little cash flow.

Landlords will often take the annual sum of the extra expenses, divide by twelve, and bill on a monthly basis.

When evaluating a retail space, request a comprehensive estimate of your monthly payment. Depending on your space, additional expenses could equal base rent, doubling your monthly payment amount. This could devastate your budget if you weren’t prepared to pay for it.

Although it is the most common type of retail lease agreement, a triple-net lease has its challenges. Retailers need to fully understand these additional expenses before signing a lease.

EXPERT TIP: It is generally accepted that a tenant can negotiate a cap on common area maintenance expenses and request a copy of insurance policy information before signing an agreement. If you want to cover all your bases, consider asking for these.

What other expenses should I anticipate?

In addition to the three “nets,” or operational costs, bundled in a triple-net lease agreement, there are other expenses retailers need to consider. Other expenses associated with renting a retail space include:

- Utilities

- Furniture, fixtures, and equipment

- Broker fees

- And retail space customizations.

Utilities are not included in a triple-net lease. These are separate and managed by the tenant. The average cost of utilities for commercial spaces in 2020 was $2.10 per square foot.

In older buildings especially, heating and air conditioning costs can be high. Consider what it’s going to take to keep the building comfortable for customers and staff year-round.

Furniture, fixtures, and equipment (FF&E) have price tags too. These are all things that retailers need to open for business. And depending on your existing operation, you may or may not have invested in any of them yet.

For retailers that are doing pop-up sales and direct-to-consumer deliveries/pick-ups and have minimal equipment, furnishing a space is a sizable upfront cost. These tangible items don’t have to be bought all at once. But they need to be budgeted for.

Broker fees are often unseen and forgotten about until the moment the lease is signed. Then it can hit like a wrecking ball. The average retail space broker commission is between 7% and 10% of the total lease cost.

Not all tenants use brokers to find retail spaces. It can be great to have a commercially licensed broker do the scouting for you. Just make sure you know the fee you’ll be paying when you sign your lease.

Built-out or retail space customizations can be pricey. Rarely is a retail space configured for an exact set of needs. Different shelving, counters, and structures are necessary for a boutique versus an ice cream shop.

Add up your construction costs plus rent to inhabit the space during construction plus the opportunity cost of not being open for business. This gets costly fast.

Ways to reduce extra costs and stay financially whole

All of the extra costs on top of a NNN agreement make signing a lease a big investment. But there are ways to reduce costs by taking advantage of some common financial perks for tenants.

Tenant Improvement Allowances can help offset build-out costs. And rent abatement is a way to save money to go toward other extra costs.

Tenant improvement allowances (TIAs) are negotiated with a landlord. TIAs are given to a tenant after a build-out is completed. The cost to do the construction is paid upfront by the tenant, and the allowance is often based on square footage.

For example, if you rent a 3,000-square-foot space, you could negotiate a $20/square foot TIA. This equals $60,000. This affords you a $60k renovation or build-out if the landlord approves the investment in the property.

Keep in mind, landlords will require a paper trail with liens, receipts, proofs of purchase, and subcontractor agreements before they’ll cut the allowance check.

Rent abatement is negotiated free rent. This is when a landlord waives monthly rent payments. Before signing a lease, tenants can negotiate rent abatement with good cause.

Some of the reasons why a landlord may approve a rent abatement request include:

- Their property has been vacant for longer than they’d like. They’re incentivized to sign an agreement and meet a tenant’s terms.

- If a tenant agrees to a longer-term lease (5+ years), a landlord is more likely to agree to several months of upfront or periodic rent abatements.

- Instead of a TIA, a build-out that a tenant pays for in full would improve the property. A landlord may be willing to offer a rent abatement instead of a construction allowance.

- If a tenant has threatened to default rent payments, a rent abatement period may be granted. It’s in the landlord’s best interest to keep tenants in their agreements.

EXPERT TIP: Down the road, if you consider asking for rent abatement, make sure the terms of the abatement are in your best interest. Landlords may be offering abatement only on “base rent” in a triple-net lease agreement. In that case, the cost of CAM expenses, taxes, and insurance still fall on you.

Moving forward with a retail lease

Despite a global pandemic that has forced multichannel retail experiences to rise in prominence, in-store shopping isn’t going anywhere. A COVID-19 retail report showed over 89% of retailers saying in-store sales will fully recover if not exceed pre-pandemic sales.

Retailers that are considering opening a retail store should move forward with it. At least evaluate your options. Now is a good time to expand beyond pop-ups, craft fairs, front porch pick-ups, and online sales channels.

Try Shopify POS for omnichannel selling

Bring your in-store and online sales together with Shopify POS. Gain insights about your business from one view so you can work smarter, move faster, and think bigger.