Japan to hike subsidies to 2nm chip maker Rapidus, an IBM partner

Japan will increase the financial support it’s giving to semiconductor maker Rapidus — established with the aim of making cutting-edge, 2-nanometer chips — in order to further support domestic production, according to Japanese trade and industry minister Yasutoshi Nishimura.

“The government is ready to continue and beef up financial support to the company,” Nishimura said in an interview with Bloomberg. He added that the plan will require the government to invest trillions of yen in the project.

The Tokyo-based manufacturer was established in 2022 with the aim of making 2nm chips in Japan by 2025. To date, it has received ¥70 billion (US$532 million) from the Japanese government, in addition to investments from Toyota, Sony, and telecom giant NT&T.

Rapidus also has international support, working with IBM and Interuniversity Microelectronics Centre (IMC) of Belgium on its production plans.

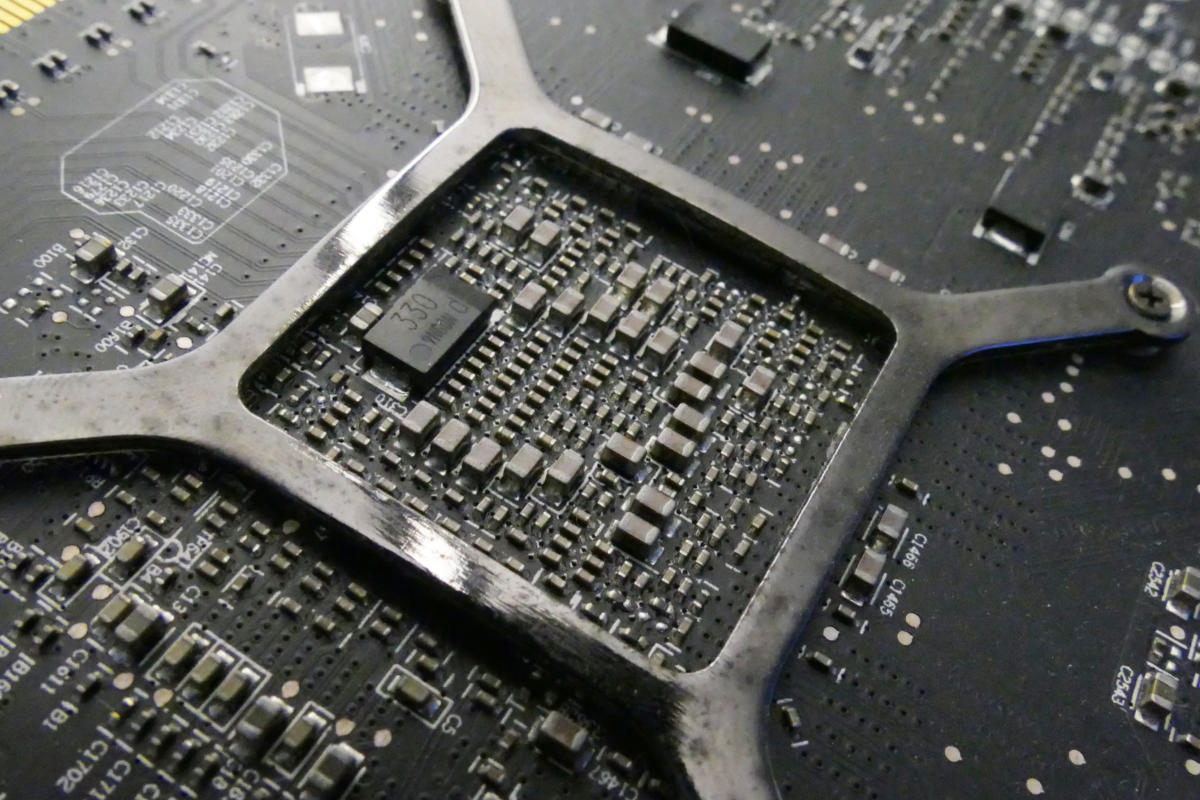

IBM announced in 2021 that it had developed a 2nm chip, and then late last year unveiled a partnership with Rapidus calling for commercial production of 2nm chips, with manufacturing done in Japan. Chips made with the 2nm manufacturing process will be used for a wide range of applications and machines, from laptops to high performance computing servers, and are expected to slash the carbon footprint of data centers due to optimized performance.

Japan’s pledge of support for Rapidus comes at a time when an escalating US-China trade war has seen widespread restrictions placed by Western countries on the export of chips to China.

As a result, global enterprises have been forced to analyze their supply chains to determine how they may be affected, since advanced semiconductors are used in a range of products, including vehicles and servers handling AI workloads.

Domestic chip production is on the rise

Government financing of domestic chip manufacturing is not a new concept. The top semiconductor producing countries — China, South Korea, and Taiwan — all have semiconductor manufacturing subsidized by their respective governments.

Furthermore, in recent years, a global semiconductor shortage driven, in part, by the coronavirus pandemic and supply chain issues, has led a number of countries to start investing in domestic semiconductor manufacturing.

A report from the US Department of Commerce released in January 2022 revealed an “alarming” shortage of computer chips, with demand growing by 17% between 2019 and 2021. In addition, according to a report by the Semiconductor Industry Association, in 2022 the US only produced about 12% of the world’s computer chips, a significant drop from the 37% the country was producing in the 1990.

As a result, US President Joe Biden passed the the CHIPS Act in March 2023, a $50 billion program that includes $39 billion worth of incentives to expand or build manufacturing facilities.

“Semiconductor chips are the building blocks of the modern economy — they power our smartphones and cars. And for years, manufacturing was sent overseas. For the sake of American jobs and our economy, we must make these at home. The CHIPS for America Act will get that done,” President Biden tweeted last year.

Next read this: