Chargebacks 101: How to Prevent and Deal With Retail Chargebacks

A chargeback happens when a customer asks their card-issuing bank to reverse a transaction. People request chargebacks for all kinds of reasons—some sinister (like friendly fraud), some because the item they bought never arrived.

Because it’s so easy for customers to initiate a chargeback, retailers are bound to experience a request at some point or another. It’s why chargebacks cost merchants 0.47% of their total revenue each year.

It helps to understand the chargeback process, what causes them, and how you can take measures to minimize the damage. This guide covers exactly that.

Table of Contents

What is a chargeback?

A chargeback occurs when a cardholder questions a transaction and asks their card-issuing bank to reverse it. Also referred to as a payment dispute, it may sound like a return, but it’s completely different.

With a return, the customer gives the goods back to the retailer and gets a refund on the money they’ve spent. With a chargeback, the banks get involved and the disputed funds are held from the business until the payment card issuer works things out and decides what to do.

If the bank rules against the retailer, the funds are returned to the cardholder. To add insult to injury, retailers are also charged a fee by the merchant services provider to investigate and resolve the chargeback. These fees usually cost a minimum of $25 per incident, and they can quickly add up. But if the bank rules in your favor, they’ll send the disputed funds back to you.

The purpose of credit card chargebacks

Security for customers

Chargebacks exist to make it safer for customers to shop. They protect customers against criminal fraud. Should someone skim their card details and use their bank account to buy something online, customers can request a chargeback and get refunded for the item they didn’t buy.

Customers are also protected from card cloning. If their credit or debit card is cloned and used to make fraudulent in-store transactions, they can request a chargeback from their bank.

Keep merchants honest

Financial crime is a good enough reason for chargebacks to exist. But it’s not just fraudulent activities that credit card chargebacks help with. They also keep retailers accountable for selling high-quality products.

The possibility of a chargeback prevents merchants from selling defective products. Should they sell a sub-par version of an item, the customer is entitled to request a chargeback. There’s no loophole a retailer could jump through to keep the money they’ve made from selling a defective item.

Chargebacks also prevent merchants from not delivering products or failing to give refunds. The bank handling the chargeback will ask a retailer for proof of delivery or its refund policy. A lack of proof or a returns policy that goes against consumer rights law means the customer wins the chargeback.

The chargeback process explained

There’s a specific process that a customer, retailer, and bank goes through when dealing with chargebacks. Here’s what it looks like.

Purchase is made

To qualify for a chargeback, a purchase must be made. This is the first stage in the chargeback process: the customer buys a product from a merchant, either in-store or online. The retailer’s payment processing system collects the money from a customer’s bank account using their credit or debit card information.

Customer issues chargeback

When a purchase has been made, details of the transaction appear in their credit card statement. Should they not recognize the transaction or receive the goods, the customer issues a chargeback.

Most banks allow customers to request a chargeback through their mobile banking app. Customers will need to share the transaction they want to be refunded for and the total amount. Other banks have a standard claim form for chargebacks.

Regardless of the method used to initiate a chargeback, it’s advisable for customers to keep records relating to the disputed transaction. Banks may need a purchase receipt, a copy of the retailer’s returns policy, or any communication they’ve had with a merchant about the issue to launch an investigation.

Issuing bank contacts merchant bank

As soon as a customer’s bank account has filed the chargeback, the issuing bank communicates with the merchant’s account to verify the transaction. The issuing bank will present evidence for the chargeback, including why the customer is entitled to one.

Issuing bank makes judgement on validity of chargeback

The merchant’s bank receives the chargeback request and reviews the evidence. If the claim is accurate, a chargeback will be issued. Certain cards—including Visa—give time limits for the merchant bank to respond to its evidence. This is usually 30 days of submitting chargeback evidence.

Issuing bank informs customer

Regardless of the outcome, the issuing bank reports back to the customer with a decision on their chargeback request. If it has been granted, the issuing bank will claim money from the merchant’s bank and refund it to the customer.

If the chargeback has been denied, the customer has two options: accept that the chargeback has been denied, or give it another shot with arbitration.

Potential arbitration

If a merchant refuses to accept a chargeback request from a customer’s issuing bank, the customer has the ability to retry the transaction.

This is called pre-arbitration and can happen if the evidence previously presented was not compelling enough or there has been an update in the case. The merchant bank then has another opportunity to review the customer dispute and decide whether to accept or reject the chargeback.

If no decision is made, the card association—Visa, Mastercard, or otherwise—is called in to resolve the chargeback dispute. Merchant and issuing banks actively avoid this arbitration process because it’s expensive and lengthy.

Ultimately, once the dispute process gets to this stage in the chargeback, it’s the card issuer’s decision on whether the merchant should refund the money.

Causes of chargebacks

Chargebacks can occur for any number of different reasons. Some of the most common reasons include:

Fraud

Fraud is big business. It happens when someone gets charged for something from your store but never actually purchased the item. A point-of-sale (POS) system that accepts secure payment technologies like EMV chip cards can help protect your business from this.

But there’s also what’s called “friendly fraud”—when the customer deliberately steals from the retailer by claiming the legitimate transaction is a fraudulent charge. A fraudster purchases an item from your store and falsely submits a chargeback request claiming that they never received the item or it was faulty.

This type of chargeback fraud is a huge problem. By 2023, it’s estimated that 61% of all chargebacks filed will happen as a result of friendly fraud. Some 90% of merchants said that “cardholder abuse of the chargeback process” was a leading concern for their business.

Customer dissatisfaction

Sometimes a customer simply isn’t happy with their purchase. A chargeback can be triggered if they request a bank refund without contacting the retailer first. (Most often, chargebacks can be avoided if a merchant and customer resolve the issue without getting the banks involved.)

Data suggests that just one in 20 customers will complain directly to a merchant if there’s an issue with their purchase. The remaining 19 are likely to initiate a chargeback.

To help minimize these occurrences, make sure your return policy is clearly stated in-store, online, and even on receipts. Also, try to keep the lines of communication open with your customers so you can work together to solve product or customer service issues as they arise.

The biggest reason for our chargebacks has been the client’s dishonesty. Sixty percent of them are claimed without even an email to explain there is a problem with the jewelry we had shipped to them, with no explanation and no intent to give us the opportunity to solve the issue.

Technical issues

Maybe it was an expired credit or debit card, a website glitch, or the customer simply clicking something in the checkout process that they didn’t intend to. For whatever technical reason, a customer can request a chargeback if they feel they were incorrectly charged.

To combat this kind of problem, make sure you have a reliable ecommerce solution that facilitates a hassle-free checkout process. Shop Pay, for example, limits distractions at the checkout. Customers know exactly what they’re buying before they complete their order.

Shipping issues

A customer could also initiate a chargeback when they bought something but claim they never received it in the mail. It’s estimated that 26% of chargebacks happen because the product never arrived.

Always have tracking numbers ready and make sure your shipping system is as streamlined as possible to decrease the chances of this happening. It’s also worth choosing a shipping provider that supplies proof of delivery—such as a photograph of where the item was delivered to.

Alternatively, ditch shipping-related issues for local customers by offering buy online, pickup in-store or curbside pickup options. That way, a customer has to visit your store to collect the parcel they’ve purchased online. Nothing can go missing in the post.

Unrecognizable business name

Are you trading under an alias of your registered business name? If your online store is branded as Bob’s Best Bits but your company’s legal name is Bob’s Online Trading, customers may get confused when they see the latter on their bank statement.

A bank statement showing money paid to an unrecognized business is a legitimate reason to request a chargeback.

Customers should be informed about how a charge would look on their bill, according to businesses. This can be accomplished by posting a statement on the merchant’s website, sending a confirmation email, or calling the customer.

Failure to cancel subscription

An increasing number of merchants are adding a new revenue stream in the form of subscriptions.

Convincing customers to take a free trial is one way to get them into the subscription model. However, when the customer forgets to cancel the subscription and is billed for the first time, they head to their bank and request a chargeback.

Subscribe to the Shopify Retail blog

Get retail insights straight to your inbox

Unsubscribe anytime

Chargeback reason codes

A reason code is how banks categorize the reason for a chargeback.

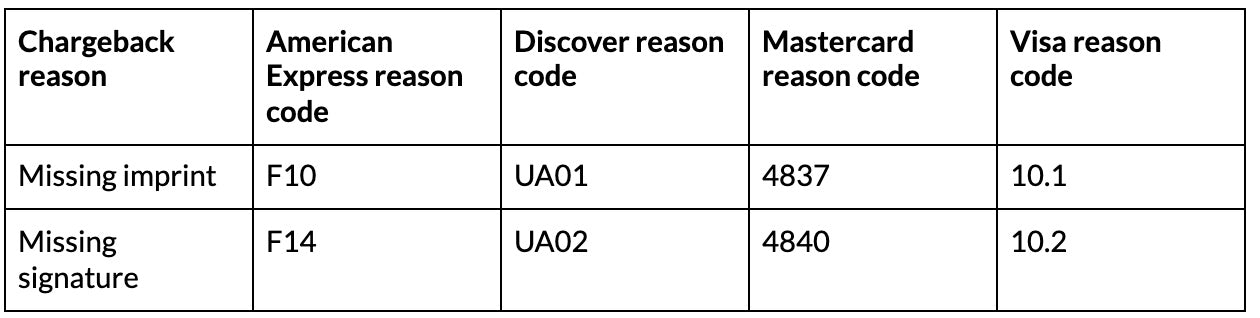

Technical

As we touched on earlier, chargebacks can happen due to technical errors. Spot these types of chargebacks using the below reason codes.

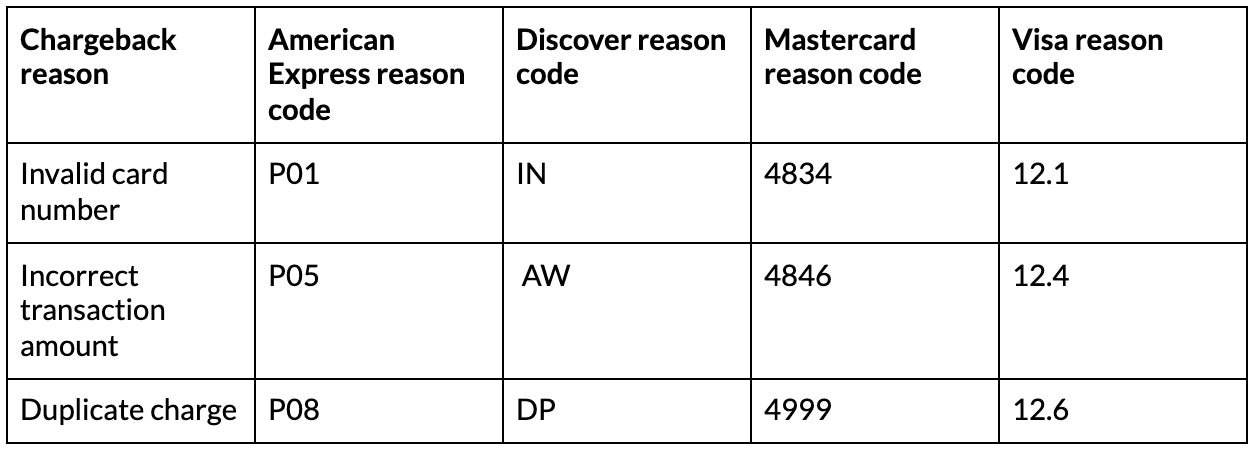

Clerical

Much like technical errors, chargebacks can be requested when a clerical error has been made—like a customer being charged the wrong amount. Find this type of chargeback with the below reason codes.

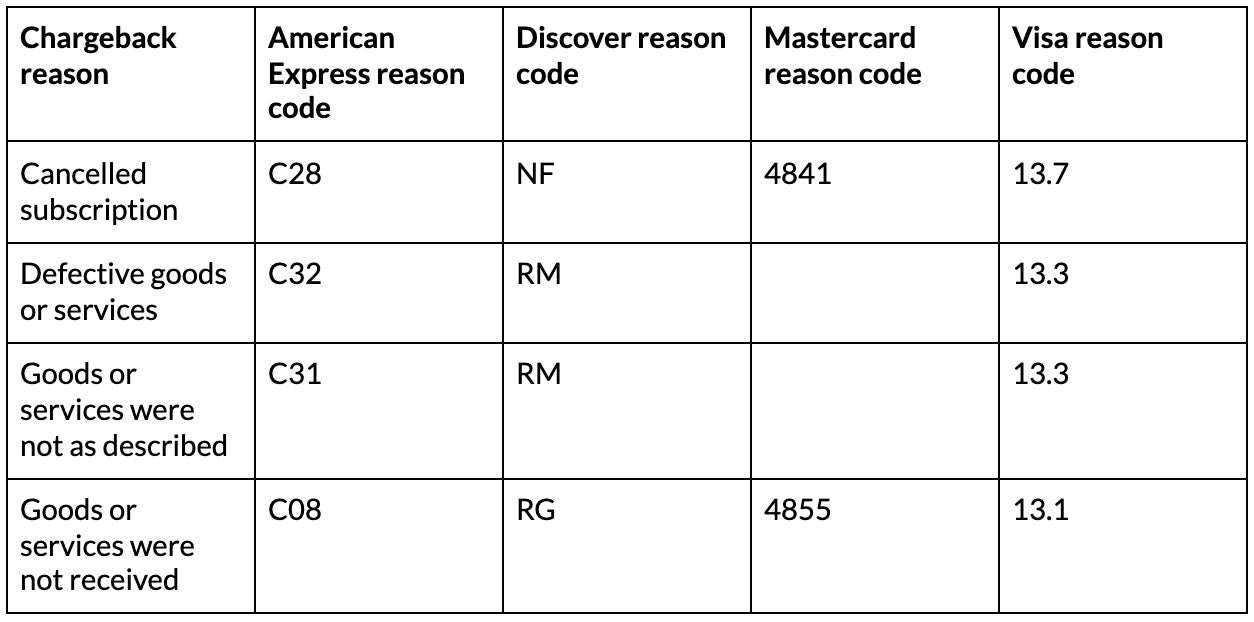

Quality

If a chargeback is requested as a direct result of the quality of the sold item, the chargeback will have one of the following reason codes.

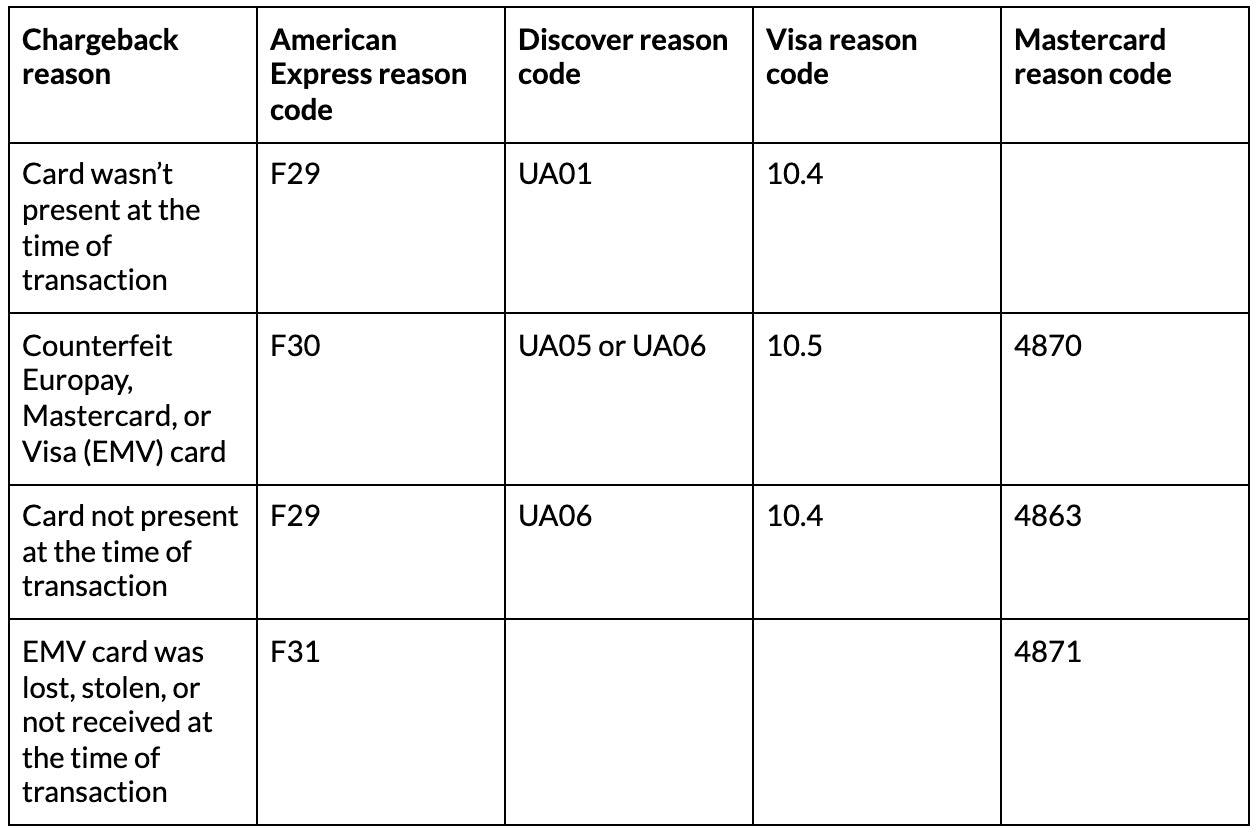

Fraud

Chargebacks with the following reason codes are requested due to fraudulent activity.

Consequences of chargebacks

Consequences for merchants

While it would be great to be able to proactively prevent chargebacks, they’re an inevitable part of running a business that you’ll likely have to deal with at some point. If you’re lucky, chargebacks are only an occasional annoyance. On the other hand, too many can penalize you as a retailer and result in a complicated process involving a lot of paperwork, time, and money.

Chargebacks are meant to help protect customers from unauthorized transactions and create a sense of security, but they can sometimes mean big headaches, especially for small businesses. If the consumer files a chargeback and keeps the merchandise, the retailer not only loses that money, but also any money they could have made off that product in the future.

On average, it costs retailers $25 to deal with one chargeback incident—sometimes more than the profit they were making on the disputed order.

Fines exceeding $10,000 can also be levied against businesses where monthly chargeback rates go over a certain number. Too many fines and the retailer may be labeled as “high risk” by credit card companies and even lose credit card processing privileges or be hit with higher chargeback fees and penalties.

Not only that, but retailers accepting card payments are bound by EMV security standards. Merchants are liable for any fraudulent activities that happen after swiping a customer’s EMV card (instead of processing a chip and pin transaction).

? PRO TIP: Shopify Payments comes with Automatic Dispute Resolution, which can nearly double your win rate from unnecessary chargebacks.

Consequences for customers

For consumers, there can also be negative consequences other than losing their money. These consequences deter people away from claiming a chargeback for fraudulent reasons—like claiming they never received the goods in question and getting a full refund. After all, a customer who won a chargeback dispute is nine times more likely to initiate another.

To deter customers from making fraudulent requests, the chargeback process is much longer than the average refund. It’s often faster and quicker for a customer to contact the retailer directly and iron-out the issue.

If a customer does proceed to file a chargeback and the bank discovers it’s a case of friendly fraud, they might close that credit account, which will negatively affect their credit score. That has a domino effect on their ability to make big purchases with other merchants.

Customers are also asked to cover the fees of a chargeback if they lose the dispute—another way banks disincentivize fraudulent chargebacks.

How to respond to chargebacks

You should respond to a chargeback as quickly as possible, since delayed action on your part can result in a chargeback loss. Research the purchase and contact the customer. Sometimes all they want is to have someone hear their complaint, and often the situation can be resolved in your favor.

Verify that you’ve received authorization for the proper dollar value of the order, and get authorization for each package shipped out from the store/warehouse.

If the chargeback is already filed, your best plan of action is to gather as much information as possible. Write up a detailed account about how one purchases your product or service and submit all of this to the acquiring bank—which will have sent you the chargeback letter.

It’s vital that you know the chargeback’s reason code so you can properly craft your response. It’s just what it sounds like—the reason they’re fighting the charges, which can range from fraud and non-delivery of services to processing errors—and the codes for each problem differ between card networks.

Fraud, or “no authorization” chargebacks, account for 56% of all chargebacks, so providing evidence that the cardholder was aware of and authorized the transaction being disputed is imperative. Any evidence that proves this—AVS (address verification system) matches, CVV confirmations, signed receipts or contracts—is critical for your response.

Also be sure to include the case number or case ID assigned to a chargeback on every page of your response. After you submit a rebuttal, the situation is out of your hands while the processor’s acquiring bank reviews the information. It’s the cardholder’s bank that makes the final decision about whether it will process the chargeback, and it will inform the customer of its decision.

Finally, if you realize you made a mistake—maybe you incorrectly keyed in the number or wrote it down wrong on a telephone order—accept responsibility and the chargeback. You want to keep your well-deserved favorable reputation with the financial institution and your customers.

How to protect your retail store from fraudulent chargebacks

Although merchants responded to 43% of chargebacks, the average net recovery rate was just 12%.

With chargebacks, prevention is definitely better than cure. Here are three simple steps that retailers can take to reduce their volume and frequency of fraudulent chargebacks.

Use fraud detection software

Sometimes, the best way to prevent chargebacks from occurring is to limit the environment in which they’re most likely to happen.

Installing fraud prevention software is the easiest way to avoid transactions that could potentially lead to chargebacks. In fact, research found that merchants who receive fraudulent alerts saw a 19% drop in chargebacks.

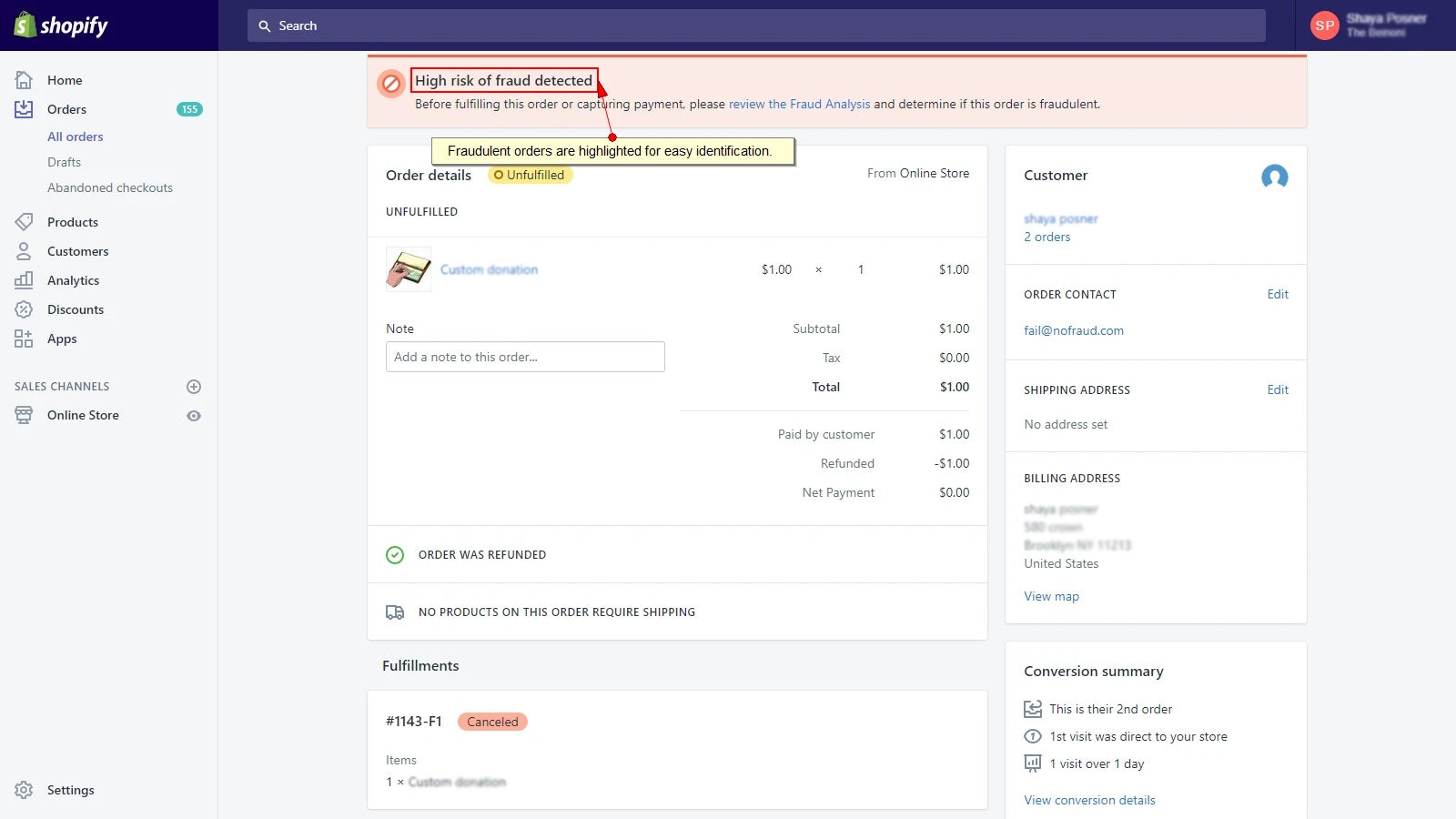

To prevent chargeback claims, customer care representative Ashley Shook explains that Calista uses “a fraud detection app called NoFraud. It screens and analyzes customer orders shortly after they’re placed. If it detects any suspicion of fraud, the order will be passed on to an analyst on their team.”

Shook adds, “That analyst will pass or fail the order. If it fails, the payment is not captured and the order isn’t put through. If a fraudulent order slips through the cracks and gets us a chargeback, NoFraud will cover the cost of that chargeback. It’s incredibly helpful!”

Keep accurate records

Keep accurate records of customers’ credit card transaction dates, amounts, authorization information, etc., in case you need them to fight a chargeback (also keep all your receipts).

Because chargebacks can happen due to cloned or stolen cards, compare the receipt signature with the signature on the back of the credit card to make sure they match up. You can also ask for another form of ID if you’re suspicious of a fraudulent transaction.

If an order shows a high risk, we reach out to the customer and request a copy of their ID. If the delivery address is different to the address on their ID, we also request proof of their address. Without these we will not fulfill the order and will just issue a refund.

Clearly describe store policies

Another way to prevent fraudulent chargebacks is to clearly describe your products and service policies—especially if you sell online—so the customer is more likely to assume liability for unsatisfactory purchases.

Set a clear return policy. That way, if a consumer is unhappy with their purchase, you can avoid a chargeback by processing it as a return instead.

You should also clearly display your contact information both on credit card receipts and online, and encourage customers to call you with questions before automatically filing a chargeback. It saves everyone fees and dramatically reduces the time you spend evaluating whether to give the refund.

Combatting retail chargebacks

While retailers are never going to love chargebacks, consumers need this level of protection when buying items from merchants. Chargeback rules encourage fair and honest return policies and discourage the selling of sub-par products.

However, consumers do occasionally abuse the system and retailers literally have to pay the price—and then some. Hopefully, with increased education about chargebacks, for both retailers and merchants, the number of fraudulent chargeback claims will decrease in the future.

Use the tips in this guide to prevent them from occurring. But at the very least, now you know how to deal with them if some chargeback requests slip through the cracks.

Handle retail chargebacks with Shopify POS

Merchants who choose Shopify to run their business get fully-integrated payment processing and Automatic Dispute Resolution, which consolidates transactions made in-store and online, receipts, shipping, and package tracking, helping you win more disputes and spend less on chargeback fees.