Championing the Value of the Budgeting Tool

Inflation is demanding that we prioritize our spending to ensure we live within our means. Clients who create and follow a monthly budget will be better prepared to deal with the high prices of gas, groceries, and everyday household items.

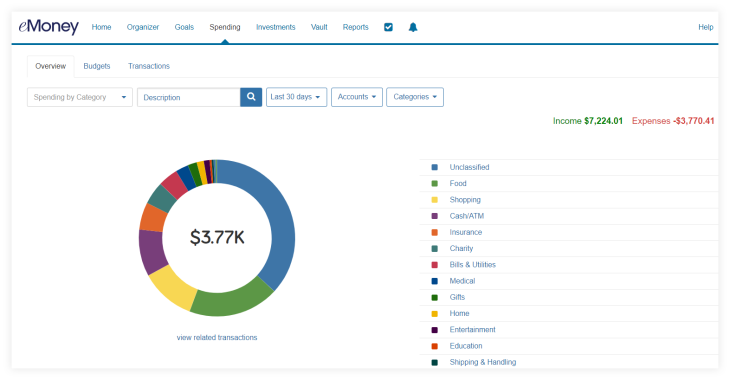

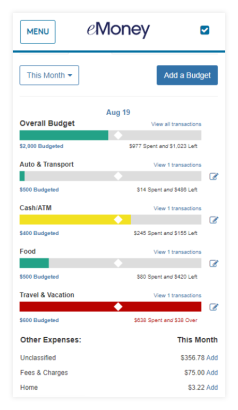

The budgeting tool on the eMoney Client Site helps clients break down their expenses to prioritize their spending, especially as we get closer to the holidays.

Although creating a budget might seem like a simple task for some, many need assistance learning how to do this effectively. The budgeting tool makes this process smoother for you and your client.

How to set up budgets on the Client Site:

Note: Accurate data is key to creating a practical and realistic budget. Make sure your client has established their connections with all their financial accounts before creating a budget.

Click the Spending Tab at the top navigation bar, from the Client Website:

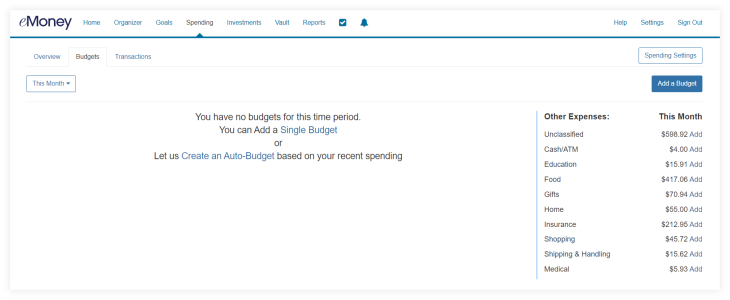

And then click Budgets

You’ll notice two options for creating a budget—choosing Add a Single Budget allows the client to create one manually, or they can choose Create an Auto-Budget to set budgeting goals directly from their recent spending.

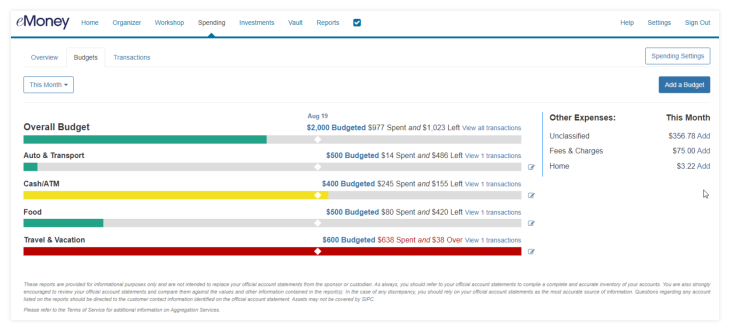

For this example, we will select Create an Auto-Budget.

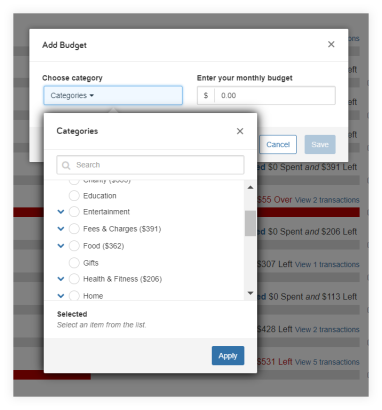

You and your client may likely find yourselves taking extra time during this step, as this is where personalization plays a big role. For example, the client can add another budget that is important to them such as Spending, if they like to shop. They can do this by clicking the blue Add a Budget to the right of the screen. Once they select a Category and enter an amount they will hit Save and it will be added as a budget moving forward.

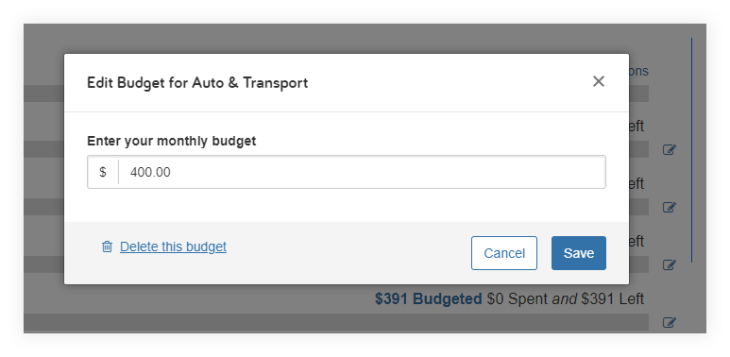

If the client needs to adjust a budget that is already listed, they can select the pencil icon to the right of the budget and make changes to the amount, or delete the budget altogether.

Our recent updates to the Budget tool also bring a more mobile/tablet-friendly experience to the Overview, Transactions, and Budgets pages. Allowing your client to check their spending and budgeting as many times as they wish throughout the week.

Learn more about the Client Portal and Budgeting tool from our Webinar Recap on Client Portal Builds a Bridge Between Financial Goals and Reality.