How to Invest In Apartment Buildings – The Ultimate Beginner’s Guide

Jeff Rose, CFP® | September 02, 2022

Investing in real estate can be lucrative and a great way to diversify your portfolio. With inflation soaring, many investors are turning to different real estate investments to increase their income.

When it comes to real estate investing, there are several directions that you can go. Most new real estate investors will turn to simple single-family homes to get started before they look into anything too complex. However, if you want to maximize your real estate earnings, you might consider investing in apartment buildings.

In this article, we’ll look at how to invest in apartment buildings so you can determine if it’s an investment decision you’ll want to make. And if you don’t have millions of dollars in capital sitting around, don’t stress—we have options for everyone with varying budgets and investing experience levels.

Is an apartment building a decent investment?

When investing your money, you want the highest returns possible while minimizing risk so as not to waste time or energy. You’ll notice more potential for higher profits as you learn how to invest in apartment buildings.

Here are a few benefits of investing in apartment buildings:

- You can get a positive cash-flow asset that pays you every month.

- The property will (hopefully) appreciate every year.

- With more units, you can bring in more revenue.

- You don’t have to deal with the volatility that has been present in the stock market lately.

- You have a hedge against soaring inflation.

How to invest in apartment buildings

These are six different ways to invest in apartment buildings if you’re new to the space. Your choice will ultimately come down to what’s comfortable based on your circumstances and goals.

There are three crucial factors to consider before deciding how to invest in an apartment building:

- Your risk tolerance. Can you handle the risk involved with investing in an apartment building? How much risk can you manage?

- The capital you have to invest. How much money do you have to invest in apartment buildings?

- Your level of real estate knowledge. Have you invested in real estate previously?

Let’s take a closer look at how to invest in apartment buildings.

Option 1: Buy an apartment building yourself as a real estate investor.

You can research and begin investing by purchasing an apartment building as a solo investor. While this may be the most intimidating option, the good news is that you can keep all the profit to yourself.

What should you know about buying an apartment building on your own?

The most important thing to remember when investing on your own is that all of the responsibility will fall on you. You’ll be on the hook for maintenance work, tenant conflicts, collecting payments, and other tasks. It’s helpful to have several reputable real estate contacts to hire as help for legal, financial, or maintenance concerns.

When you own the apartments you stand to make more of the profit but that also means you’re on the hook for everything else.

On the plus side, buying an apartment building on your own means you get to keep all of the profits, and you can implement your vision for the property. You can also write off many of your property-related expenses on your taxes.

What are the steps involved with investing in an apartment on your own?

- Save up your money. You’ll need a decent chunk of change to get approval for a mortgage for an apartment building.

- Look for deals/opportunities with a trusted broker. Finding a trusted broker you can work with to help you go through listings is essential.

- Find a mortgage. You’ll want to consider getting pre-approved for a mortgage so that you already have the financing figured out when making an offer.

- Analyze the finances and review deals. You will want to spend the most effort here to ensure you’re getting into a profitable deal.

- Make an offer and wait for it to get accepted.

- Consider a property management company. Once you obtain the apartment building, you may want to hire help with property management. Hiring a property manager can relieve you of some responsibilities, though it will cut into your profit.

- Renovate or update the apartment building. Many real estate investors look for buildings they can upgrade to charge more.

Some documentation you’ll need to review thoroughly before investing in an apartment building:

- Market report. What sort of properties are available?

- Financial audit. What’s the economic history of a building?

- Property condition assessment. In what kind of condition is the property?

- Lease audit. Is there any unpaid rent? What do the leases look like?

- Appraisal. What is the current estimated market value of the property?

- Site survey and title report. Are there any legal claims to the property? What are the property boundaries?

It’s essential to find a real estate lawyer you can trust to help you go through these documents and answer your questions.

We asked Daniel Shin of The Darwinian Doctor for advice on how to invest in apartment buildings, and here’s what he had to say:

“When I look at an apartment building, I consider many factors, including location, affordability, building condition, and ability to increase the value of the real estate.

Shin goes on to mention the most appealing quality:

“I’d say the most attractive quality of a building is the potential to improve the building and offer a better living environment for tenants while at the same time yielding a good return on investment.”

Gabby Wallace, a real estate expert who helps women build their rental investment income, also shared her thoughts on how to invest in apartment buildings and what she looks for:

“Generally [I look for] the ability to get a decent cash flow and appreciation from the initial investment. What makes real estate a good choice is very personal, [and] like personal finance, it depends on where people are financially and their current/long term goals.”

As you look for how to invest in apartment complexes, you may realize that you’re not ready to start independently. If that’s you, there are many other options on the table.

Option 2: Team up with a partner to invest in apartment buildings.

The next option is to find a partner for the investment, so you’re not managing risk alone or stuck with all the work. Finding the right partner can help you speed up the process and split the responsibilities—that way, you don’t become as overwhelmed.

What are the benefits of investing in an apartment building with a partner?

- You can team up with someone with experience or skills you don’t possess.

- You can raise more capital and split the expenses.

- You can divide the work.

How can you find a partner to invest in an apartment building?

There are many different ways to go about finding a partner. There are real estate investors who actively seek out partners, and there are people who just ask the contacts in their social network.

If you’re not quite sure how to find a great real estate partner, here are a few other options you can try:

- Check local investing groups on Facebook.

- Look into investment clubs on Meetup.com.

- Speak to your real estate agent to see if they have anyone in mind.

Are there any potential drawbacks to investing in an apartment building with a partner?

It’s important to highlight the pros and cons of any investment, so you’re aware of what you’re getting into.

We spoke with one real estate investor who shared the negatives of buying an apartment building with a partner. Tom Brickman, the author of The Frugal Gay blog, shared his insights on investing with a partner:

“Investing with partners is tough. On the surface it’s great. But just like high school—it falls back on one person. I have been in this a long time. I don’t want to spend the afternoon trying to fix a water heater. I’d rather replace it and go on with my day. Unfortunately with partners—new to investing—I often spend an afternoon trying to replace a water heater that could have been replaced in the morning.”

Investing with a partner can sometimes mean compromising on issues or picking up on their slack. If you’re not sold on investing in an apartment building with a partner, don’t worry—there are more ways to invest with less risk.

Option 3: Invest in a real estate syndication agreement.

A syndication agreement is where you pool your finances with a small group of investors to purchase real estate. This type of investment may be an available option for those who don’t have enough money to make such a hefty investment on their own. Many online platforms have simplified this process for fledgling investors.

Real estate syndication is much simpler nowadays and an attractive form of passive income.

A syndication agreement works when the person in charge, called the syndicator, opens their property investment opportunity to multiple investors. The syndicator does all the decision-making while the investors, also known as limited partners, receive passive income from the property.

What if you want to invest in an apartment building through a syndicate agreement?

While syndication agreements are an excellent way to make passive income, it’s not an option for everyone. An individual must be an accredited or experienced investor before qualifying for most syndicate agreements. For those who qualify, having a network of investors with similar real estate goals may help you connect with the right syndication deal.

Real estate investment firms are another excellent source for finding syndicate agreements. For example, One Group Capital, a private firm with 506(c) offerings, recently launched an investment opportunity for the Array Apartments community in Austin with a projected 17% to 22% targeted average annual return.

Option 4: Invest in an apartment building through real estate crowdfunding.

Real estate crowdfunding projects are one of the newest ways to invest in apartment buildings without doing any leg work that traditionally goes into buying real estate. Crowdfunding simply asks the general public to contribute capital to a real estate project.

| What makes crowdfunding different from a real estate syndication? Syndication is a funding relationship between a smaller group of accredited investors, while crowdfunding is a method for finding investors of all experiences. While the terms are closely related, they’re not synonymous. |

One drawback with crowdfunding is that these investments are typically illiquid, meaning you likely won’t get your money back for a few years. You may also have to pay some fees when using a crowdfunding platform.

What are the benefits of investing in an apartment building through real estate crowdfunding?

- It requires low start-up capital compared to trying to purchase an entire building on your own.

- The risks are split between multiple people.

- Crowdfunding offers access to new and exclusive opportunities you won’t find anywhere else.

- You don’t have to worry about qualifying for a mortgage.

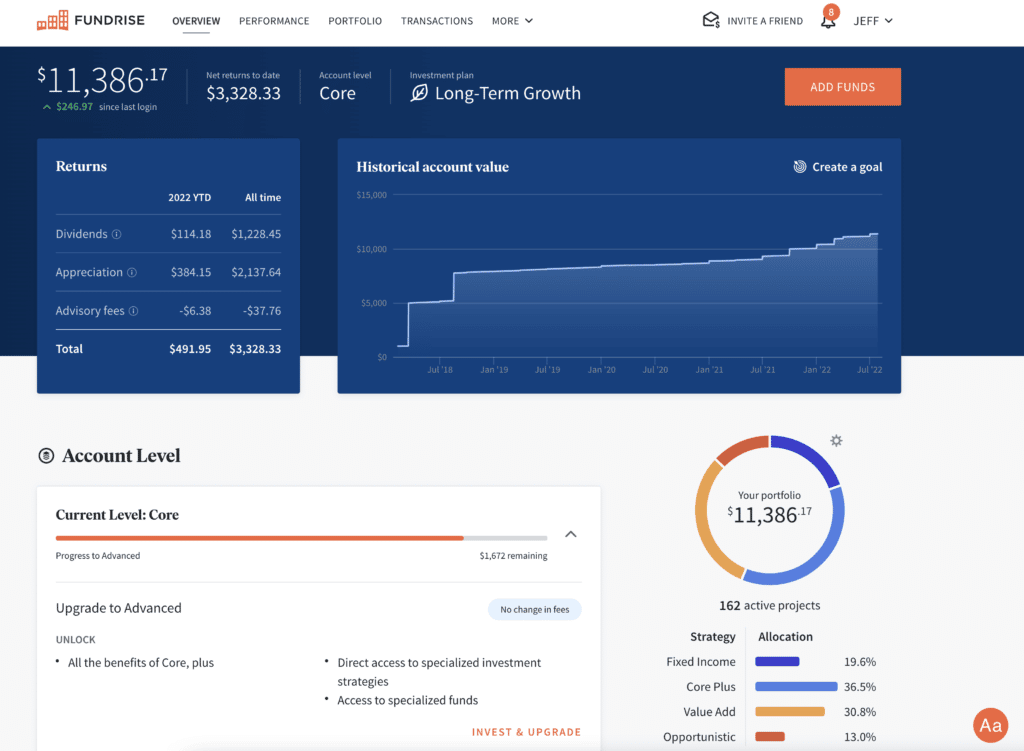

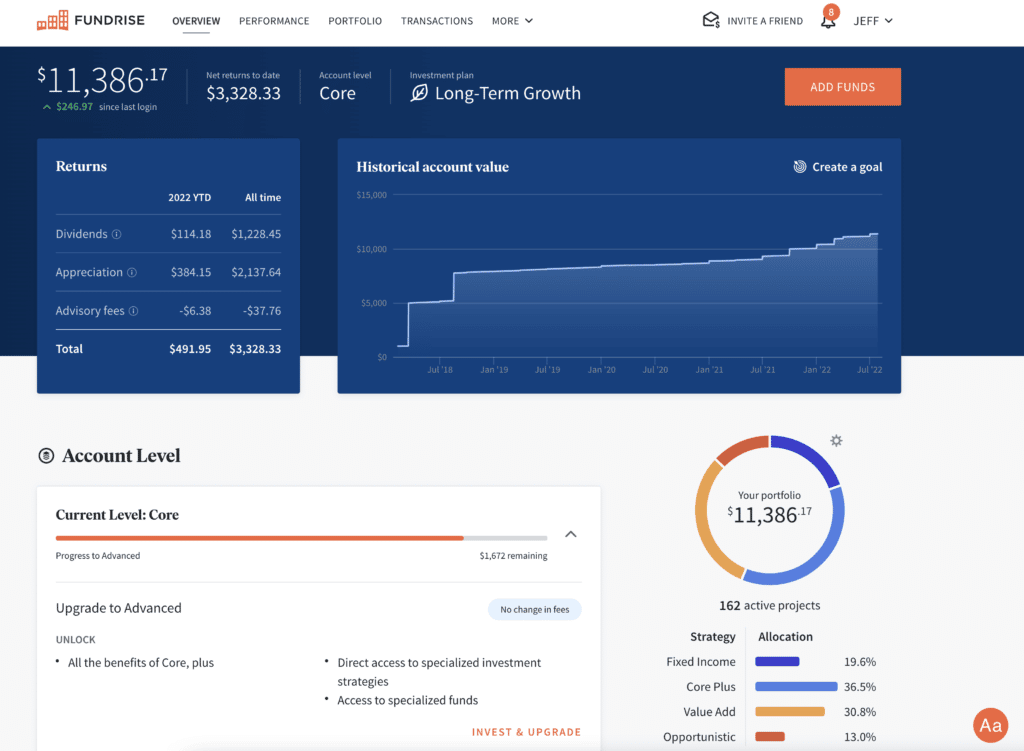

If real estate crowdfunding intrigues you, we recommend you look into Fundrise, a platform that allows folks to invest in real estate by pooling their money with others.

Fundrise makes it easy for anyone to become a real estate investor because they have low minimums to get started and are open to any investor, no matter their experience. It also has a user-friendly website where users can choose the ideal portfolio based on their budget.

Option 5: Invest in an apartment building through a REIT.

While investing in an apartment building can be a healthy option for diversifying your portfolio and a decent hedge against inflation, it comes with extensive work that you may not have time for.

If you’re not sure that you’re ready for the responsibility of investing in an apartment building as a property owner, you can always invest in a REIT (Real Estate Investment Trust). REITs are companies that own, operate, or provide financing for income-generating real estate projects.

REITs are most passive way to invest in apartment buildings.

REITs have made real estate investing more straightforward and accessible to investors with varying budgets. They’re also passive investments that don’t require any effort on your behalf—meaning you won’t have to worry about screening tenants or collecting rent.

How can you invest in an apartment building through a REIT?

Many REITs are publicly traded on the stock market, meaning you can invest when you’re ready from the comfort of your own home. You can use online brokers to invest in these REITs at any time.

What are some online brokers that you can use to invest in REITs?

- Robinhood. This is an easy-to-use, commission-free investing and trading platform.

- E*TRADE. A financial services company that allows you to trade stocks, bonds, mutual funds, ETFs, options, and futures.

- M1 Finance. A low-cost robo-advisor with a financial services app that allows integrated investing, borrowing, and banking.

What are some REITs that specialize in apartment buildings?

- Mid-America Apartment Communities, Inc. (MAA). They focus on managing, developing, and acquiring quality apartment complexes in the southeast, southwest, and mid-Atlantic U.S.

- Equity Residential (EQR). They currently own or invest in 305 properties across the nation, acquiring large apartment complexes with solid construction.

- AvalonBay Communities (AVB). They focus on the business of developing, redeveloping, acquiring, and managing apartment communities in growing metropolitan areas.

- Camden Property Trust (CPT). This Houston-based REIT invests and operates 170 properties that contain over 58,000 apartments.

- American Campus Communities (ACC). They are the largest manager, owner, and developer of high-quality student housing communities across the country.

What’s the difference between a REIT you can purchase through an online broker and a platform like Fundrise?

Fundrise offers REIT options as well as crowdfunded real estate agreements. While your standard REIT can be publicly or privately traded, Fundrise REITs are private, tend to cover various property types, and often require much less upfront capital. Fundrise also offers preset investment portfolios, depending on your goals.

Option 6: Invest in a real estate fund.

A real estate fund is a mutual fund that invests in REITs and real estate companies. To invest specifically in apartment buildings, you must seek real estate mutual funds that invest in REITs or companies specializing in multi-family units.

There are three types of real estate funds:

- Real estate ETFs (Exchange-Traded Funds): These funds will own shares in real estate companies and other REITs, and they’re publicly traded on the stock market.

- Real estate mutual funds: These professionally managed investment vehicles invest in a diverse portfolio of real estate opportunities.

- Private real estate funds: These funds are often exclusive to those with a decent amount of capital to allocate.

| Fund Name | Fund Type | Ticker Symbol | Morningstar Rating |

| DFA Real Estate Securities I | Mutual Fund | DFREX | Gold |

| Principal Global Real Estate Sec Instl | Mutual Fund | POSIX | Silver |

| Fidelity Real Estate Income | Mutual Fund | FRIFX | Silver |

| Cohen & Steers Instl Realty Shares | Mutual Fund | CSRIX | Silver |

| Vanguard Real Estate ETF | ETF | VNQ | Gold |

| Schwab US REIT ETF | ETF | SCHH | Silver |

| Vanguard Global ex-US Real Est ETF | ETF | VNQI | Bronze |

| SPDR® Dow Jones Global Real Estate ETF | ETF | RWO | Bronze |

While REITs pay out regular dividends to investors, real estate funds provide their value through appreciation. These funds also offer a healthy amount of diversification to a portfolio, making them less risky than other investments.

Pros and Cons of Investing in Apartment Complexes

Pros ✅

- Diversify investments out of the stock and bond markets

- Enjoy property appreciation and cash flow from rent payments

- Invest through funds, stocks, REITs, or direct investment

Cons ❌

- Can be cost prohibitive when starting

- Unique risks and management challenges

- Potentially high management and turnover costs

Is investing in an apartment building right for you?

Like with any investment, discussing your goals with a financial advisor before making any decisions can be helpful. But if you’re thinking about investing in apartment buildings, there are many options to choose from. Since there’s an entry point for every budget and expertise level when it comes to real estate investments, almost anyone can have some ownership of a property.

About the Author

Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the personal finance book Soldier of Finance. He was a financial planner for 16+ years having founded, Alliance Wealth Management, a SEC Registered Investment Advisory firm, before selling it to focus on his passion – educating the masses on the importance of financial freedom through this blog, his podcast, and YouTube channel.

Jeff holds a Bachelors in Science in Finance and minor in Accounting from Southern Illinois University – Carbondale. In addition to his CFP® designation, he also earned the marks of AAMS® – Accredited Asset Management Specialist – and CRPC® – Chartered Retirement Planning Counselor.

While a practicing financial advisor, Jeff was named to Investopedia’s distinguished list of Top 100 advisors (as high as #6) multiple times and CNBC’s Digital Advisory Council.

Jeff is an Iraqi combat veteran and served 9 years in the Army National Guard. His work is regularly featured in Forbes, Business Insider, Inc.com and Entrepreneur.

You Might Also Enjoy

Reader Interactions