2021 planning: New business models, big opportunity

Certainly, corporate execs and finance professionals have to focus on the future and take advantage of emerging technology. “You have to evolve to succeed,” explains Scott Brown, senior vice president of finance at tech distributor Mouser Electronics. “Whether it’s software, hardware or automation, we are investing in state-of-the-art solutions and systems to help us work smarter across all areas of the company.”

The good news: Nearly everyone is feeling optimistic. A worldwide survey of 297 business executives conducted by MIT Technology Review Insights, in association with Oracle, shows that organizations are ready to invest in innovative ideas to reinvigorate their organizations. And they’re getting the work underway.

The journey from survive to thrive

The pandemic challenged every business in 2020. It tested every element of organizations’ workflows and utterly changed their planning processes. But by autumn, most executives had a handle on the situation. When they spoke with MIT Technology Review Insights, they were busy designing strategic business plans for 2021. Among them: major business model and technology adjustments to help them achieve success.

Most execs are upbeat about their companies’ future. Few are are postponing any sort of changes for the next 18 months or putting everything on hold until things shake out.

Overall, 47% expect their business to thrive in 2021, 36% expect their organizations to transform, and only 12% are hunkering down for a bleak year of survival. Herein, “thrive” is distinguished as a successful continuation of an existing business model. Take a manufacturer of standing desks—there’s a good chance it’s selling a lot more with the influx of employees now working from home. Compare that to “transform,” or making significant changes. That might include rethinking how a company sells to customers or adding a new product line.

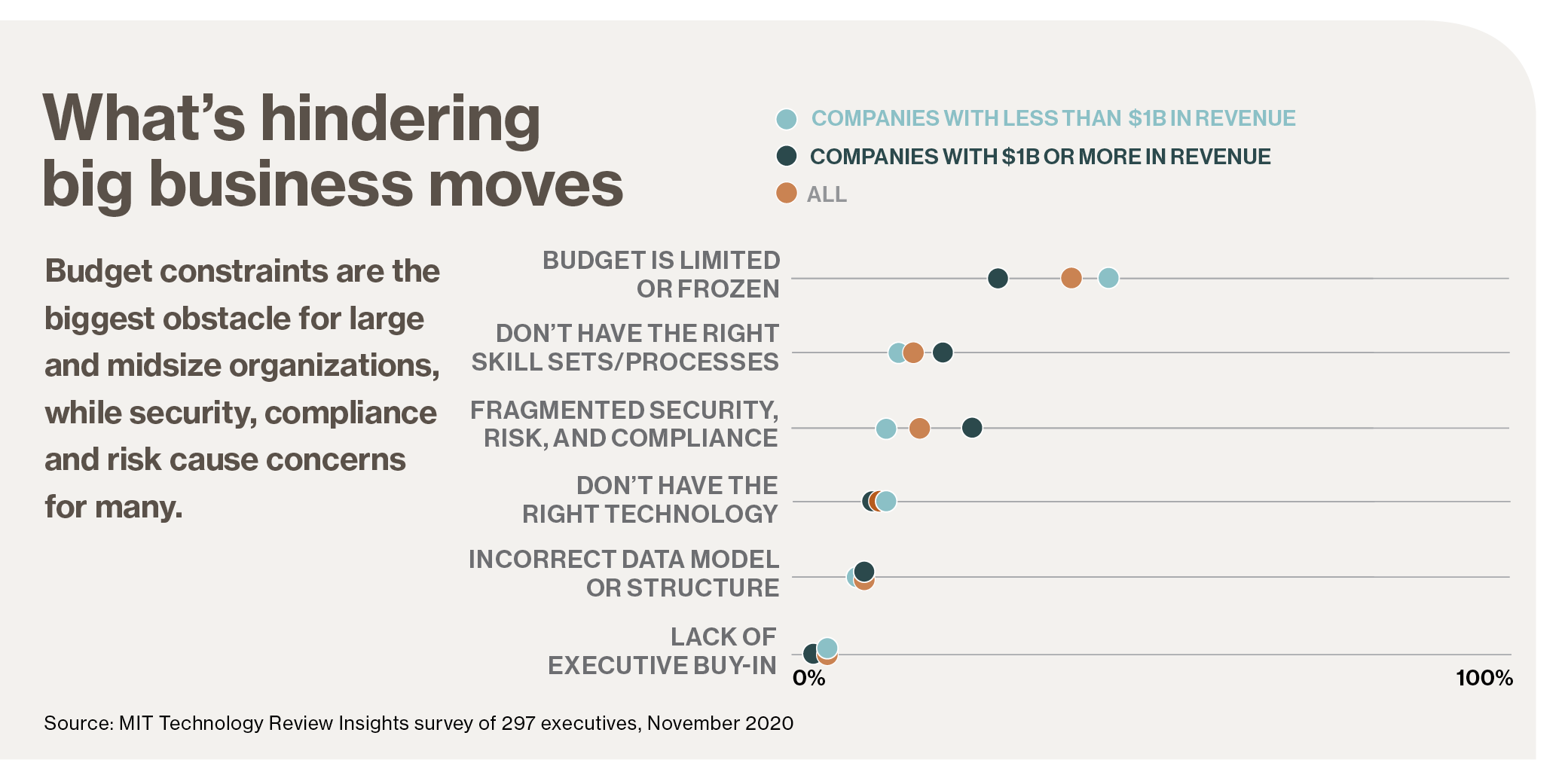

The 2021 objectives vary by company size to some degree. Large companies—which in this report are organizations with more than $1 billion in revenue—are more open to transforming; in contrast, small and midsize companies aim to thrive.

Making big moves

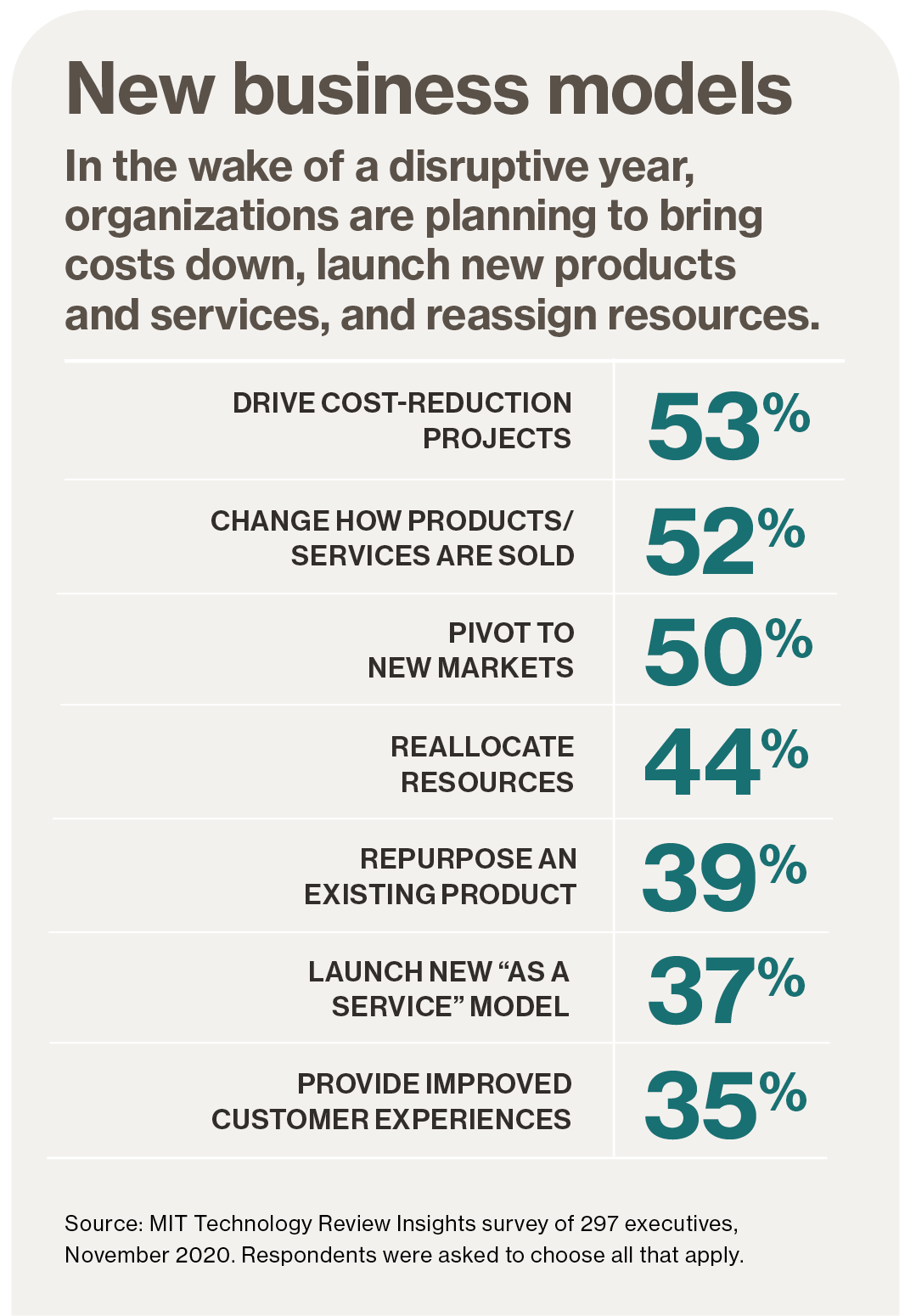

Perhaps it’s possible to cope in the short term by making modest adjustments, such as renegotiating supply chain contracts or reskilling displaced workers. But many companies have used the pandemic as an opportunity to reassess their business. Which parts can succeed mostly as-is? Which need redirection? Which should be eliminated? Where are the untapped growth areas? Whatever their conclusions, corporate executives are taking action.

These are rarely small changes. For instance, some in the retail industry quickly found ways to keep business buoyant while stores were closed—bolstering their e-commerce setups and making it easier for customers to shop online or arrange for contactless pickup at a store. The coffee industry made changes across its entire supply chain, from harvest to the local coffee shop, despite the uncertainty of demand.

In 2021, 80% of businesses surveyed are planning strategic big moves, such as acquisitions, divestitures, new business models, and widespread automation. In fact, 39% have already made a “big move” in 2020. Just over a quarter of businesses, 27%, are contemplating such plans in 2021. In some cases—14% overall—the major plans are underway but are not scheduled for deployment in the next 36 months.

Big moves are more likely to be undertaken by larger organizations; 87% of businesses with more than $1 billion in revenue have plans, compared with 76% of smaller businesses. These large-scale changes are also more common in the Americas—84%, compared with roughly three quarters with such plans in Europe, the Middle East, and Africa (EMEA), and Asia-Pacific.

Download the full report.