Small Business Tax Deadlines: Your Accounting Calendar for 2022

It seems like every season is tax season when you’re a small business owner. From personal tax returns to corporate tax filing deadlines, there are many dates set by the IRS that you need to add to your calendar.

Preparation is key. Knowing tax deadlines ahead of schedule gives you more time to prepare so you’re never left with an unexpected tax bill, nor limited time to complete an IRS tax form.

So, which dates do you need to be aware of when preparing taxes for your small business? This guide shares 2022 deadlines to file your income taxes for fiscal year 2021. Add them to your calendar so you’re better prepared than ever.

Table of Contents

Note: This guide is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional accountant.

Types of taxes for small businesses

The US government requires small businesses to pay various types of tax throughout the financial year. Let’s take a look at the four main types of taxes you’ll be expected to pay as a small business owner.

Quarterly taxes

All business owners—including independent contractors, sole proprietors, and self-employed people—who earn more than $1,000 per year are required to pay estimated tax payments each quarter. It’s a form of federal income tax using Form 1040-ES, which estimates the income tax you expect to owe at the end of the year.

Payment installments are made to the IRS after each quarter:

- Q1: 15th April

- Q2: 15th June

- Q3: 15th September

- Q4: 15th January

Depending on your business size, you might also need to make quarterly corporation tax payments. Use Form 1120-W to calculate estimated business tax, and make quarterly payments if you expect to owe more than $500 at year-end.

Annual taxes

Once all four quarters are over, both individuals and small businesses are required to submit an annual tax return. This is due on April 15th and balances out any discrepancies from your estimated quarterly tax payments.

The IRS compares your actual annual income to your estimated quarterly income.

Tax on anything above and beyond your corporate tax return projections—like a bigger-than-usual Black Friday or unexpected flash sale—would be due at this point.

The form you’ll use to file annual taxes depends on your business structure. Sarah York, IRS Enrolled Agent and tax expert at Keeper Tax, explains:

- If your small business is a Single Member LLC (meaning it’s just you), you can file your business taxes on your personal Form 1040 using a Schedule C. The due date is April 15th.

- If your small business is an LLC, but you have a business partner, you’ll need to file Form 1065 for a Partnership Return, which is due March 15th.

- If your small business is an LLC but treated as an S-Corp for tax purposes, you’ll file using a Form 1120-S, which is also due on March 15th.

The reason that Forms 1065 and 1120-S are due a month earlier than April 15th is because these entity structures flow through to the owner’s 1040 returns using a Form K-1. Consequently, their returns must be prepared first before the owners can file.

Employment taxes

Does your small business employ staff? If so, it’s your responsibility to pay federal employment taxes. Report the salary, sales commission, and Medicare withholdings for each employee throughout the tax year annually through Form 944.

Small businesses need to make employment tax payments either monthly or semi-weekly. Choose your preference at the start of the calendar year. (Many retailers choose to line employment tax dates up with payroll.)

If you owe more than $500 in employment or payroll taxes, the IRS requires quarterly payments. You’ll file these through Form 941, with payment due no later than the last day of the month following the quarter.

Federal excise taxes

Small businesses that sell specific goods and services are required to pay federal excise taxes. This is a percentage or fixed dollar amount charged on:

- Health products, such as tobacco or alcohol

- Environmental products, such as fuel or airline tickets

If your inventory matches these criteria, your business needs to file Form 720 on a quarterly basis. Like income tax returns, federal excise payments are staged throughout the year. You’ll estimate what you owe at year-end and make payment each quarter.

Free Download: 6 Steps to Get Your Business Ready for Tax Season

Tax season is stressful for any business owner. This guide will go through the process of filing income taxes in America and provide you with checklists to keep you organized and prepared.

Get your free guide

Almost there: please enter your email below to gain instant access.

We’ll also send you updates on new educational guides and success stories from the Shopify newsletter. We hate SPAM and promise to keep your email address safe.

US small business tax calendar for 2022

Overwhelmed with dates? While different states have different tax deadlines, here are the important payment and filing dates to put on your calendar.

January 2022

- Quarterly tax for Q4 2021: 15th January, 2022

March 2022

- S corporation and partnerships tax return: 15th March, 2022

- Employment tax for Q1 2022: 30th March, 2022

April 2022

- Personal or Single Member LLC tax return for 2021: 15th April, 2022

- Quarterly tax for Q1 2022: 15th April, 2022

June 2022

- Quarterly tax for Q2 2022: 15th June, 2022

- Employment tax forQ2 2022: 30th June, 2022

September 2022

- Quarterly tax for Q3 2022: 15th September, 2022

- Employment tax forQ3 2022: 30th September, 2022

January 2023

- Quarterly tax for Q4 2022: 15th January, 2023

- Employment tax forQ4 2022: 30th January, 2023

When you’ll get your tax refund

It’s not uncommon for small business owners to overestimate their tax bill. If you’ve paid too much in quarterly taxes, you’ll be due a tax refund at the end of the fiscal year.

The IRS is currently facing a large backlog of tax refund requests. There are six million unprocessed individual returns in the IRS’ backlog, so it’s taking longer than usual to process payouts.

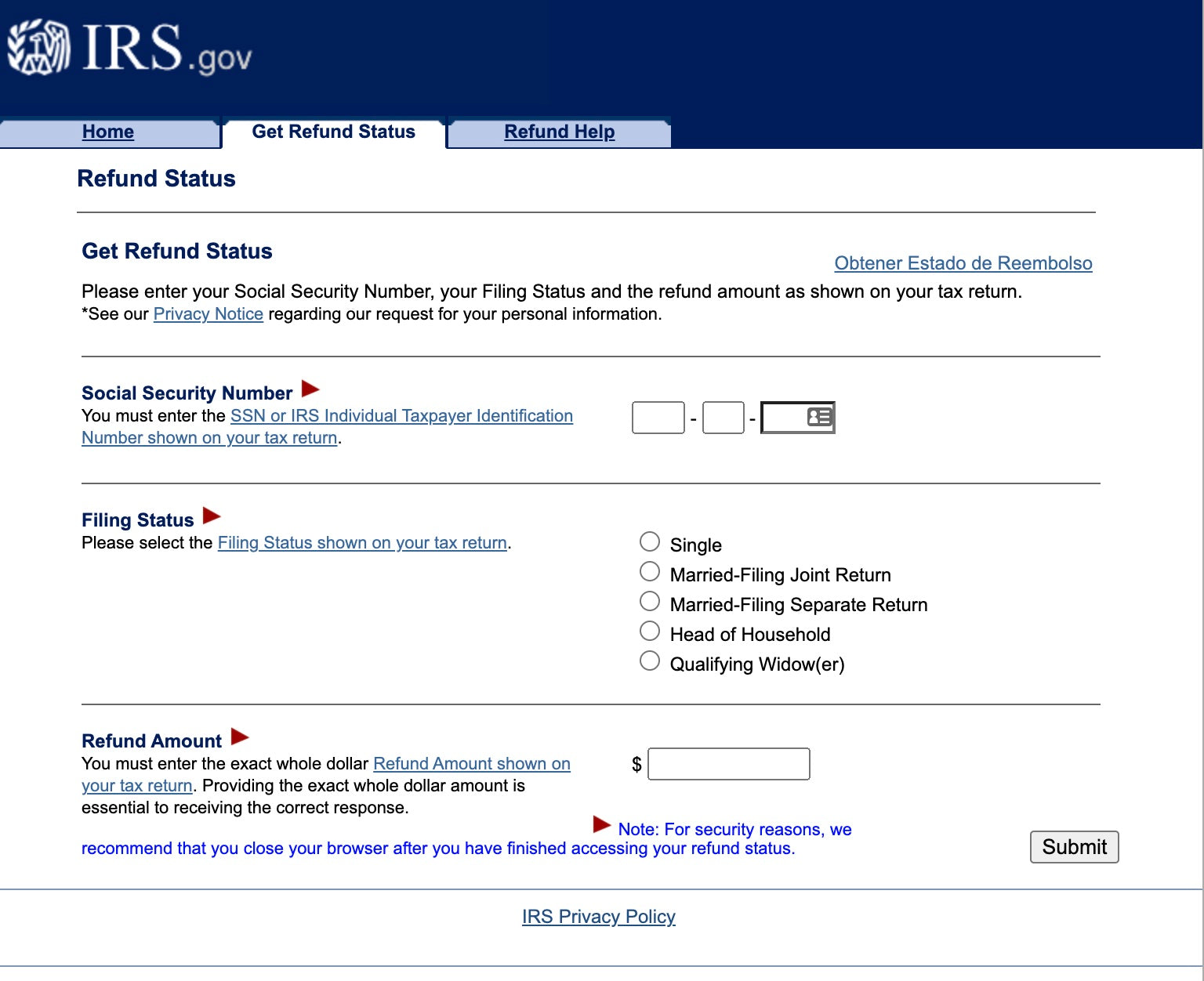

Expect to receive a refund within three days of filing your return. For more updates, use the IRS’s “Where’s My Refund?” service. Enter your social security number, filing status, and refund amount for an estimated processing time.

Tax extensions for small businesses

Not all small business owners can file their tax returns on time. Things happen; business income fluctuates and life gets in the way.

The IRS allows tax extensions if you’re unable to file for either your personal income or business tax according to the schedule outlined above. You’ll be given an extra six months to file your taxes, though late payment requests for both personal and business income taxes are not always granted simultaneously.

Request an extension using the following forms before the tax filing deadline:

“Extensions can be e-filed online or mailed to the IRS,” says tax expert Sarah York. “However, due to the current IRS backlog in sorting paper mail, I would advise using an e-file service if possible.”

Missing records, additional expenses, bills payable, expenditure discrepancies, or even an overly busy CPA, can all impact your tax liability. Conducting a full inventory of all factors and then measuring them against the advantages or disadvantages of asking for an extension should be a part of your tax deadline preparation. If you fail to do this, by the time you realize you need an extension, it may be too late.

Penalties for paying taxes late

Extensions exist to give you extra time to prepare your taxes. But if you fail to file or pay your tax return without asking for an extension (or paying before it), you’ll face penalties.

Failure to file

If you don’t ask for an extension and miss the filing deadline, you’ll be charged a late filing penalty—usually 5% of the amount due for each month up to a maximum of 25%.

If you’re 60 days past the filing due date, the IRS will fine you a minimum penalty of $435 or the balance of the tax due on your return, whichever is smaller.

Failure to pay

There’s also a late payment penalty—usually 0.5% of outstanding tax that’s surpassed the due date of your tax return pre-extension. It’s charged for each month or part of a month the tax is unpaid, up to a maximum of 25%.

You won’t be charged a late penalty if you can demonstrate “reasonable cause” for missing the payment deadline. Meet that criteria if you’ve already paid 90% of your income tax for the year and the remaining balance is paid with your annual tax return.

The IRS charges interest on late payments, too, which compounds each month your tax bill remains unpaid. The exact amount changes every three months.

Tax deadlines for non-US business owners

The above deadlines and dates are for small business owners operating within the United States. If you operate outside the US, here are some deadlines that may be applicable to you:

Tax deadlines for small businesses in Canada

Small business owners in Canada are required to submit a T2 corporation income tax return each year. The deadline for this is shorter than other countries: six months after the business’ accounting year ends.

Other important dates to lookout for in Canada include:

- Employee payroll tax deductions: 15th of the month (for the month prior)

- Income tax installments: the last day of each month or quarter, depending on your payment schedule

- Two months prior to the tax year-end: Remaining corporation income tax

Need reminders as these dates approach? The Canada Revenue Agency (CRA) runs BizApp, a mobile app designed to help you keep track of business tax deadlines.

Tax deadlines for small businesses in the UK

While the UK tax year runs April to April, the deadlines for filing small business taxes differ for limited companies. Below are HMRC’s guidelines for small businesses that operate as a limited company:

- First year’s tax return: 21 months after the date it registered with Companies House

- Subsequent tax returns: 9 months after the company’s financial year ends

- Corporation tax filing: 12 months after the accounting period ends

- Corporation tax payments: 9 months and one day after the accounting period ends

If your annual turnover surpasses £85,000, you may also have to pay Value Added Tax (VAT) each quarter of your accounting period. Deadlines to file and pay a VAT return are one month and seven days after the quarter ends. If your quarter ends on March 31, for example, your VAT deadline would be May 7.

Company directors and self-employed people in the UK are also required to pay both income tax and national insurance. This is calculated and filed through a self-assessment tax return:

- Self-assessment filing deadline: October 31 for paper tax returns; January 31 for online tax returns.

- Income tax payments: January 31 in the year following the tax return.

- Payment on account: July 31 in the year following the tax return. This acts as a contribution for your tax payments the following year.

Tax deadlines for small businesses in Australia

Business owners in Australia are liable to pay income tax on 30 June—the end of the financial year. However, the Australian tax calendar differs depending on which type of business you run. You must file a tax return by:

- 31 October for individuals, sole traders, and partnerships

- 28 February for company tax returns

All Australian companies must also submit a business activity statement (BAS) quarterly. These statements report different tax liabilities, including goods and services tax (GST), pay as you go withholding, and pay as you go installments. Deadlines to file a BAS are:

- 28 October for Q1 (July, August, and September)

- 28 February for Q2 (October, November, and December)

- 28 April for Q3 (January, February, and March)

- 28 July for Q4 (April, May, and June)

Don’t miss your small business tax deadlines

There’s a lot that goes into running a small business—accounting included. Add these important dates to your calendar with reminders in advance. Tax dates quickly sneak up on all of us.

Many small businesses find it easier to outsource tax-related activities to a tax professional. Not only will they remind you of important dates, but they’ll be able to file both personal and corporate tax returns on your behalf—no six-month extensions necessary.

Stay on top of your finances

With Shopify POS, it’s easy to create reports and review your finances including inventory costs, sales, returns, taxes, payments, and more. View your financial data for all sales channels from the same easy-to-understand back office.